- DegenDen

- Posts

- BTC finally stops being the Nasdaq’s drama cousin...

BTC finally stops being the Nasdaq’s drama cousin...

and starts having meltdowns on its own schedule.

Intro

Hey Degens,

For years, the lazy description of BTC was:

“It’s basically a leveraged QQQ.”

And to be fair, for big chunks of the last cycle, that wasn’t totally wrong:

Fed eases → stocks up → BTC really up.

Fed tightens → stocks down → BTC really down.

But the second half of 2025 blew that relationship up.

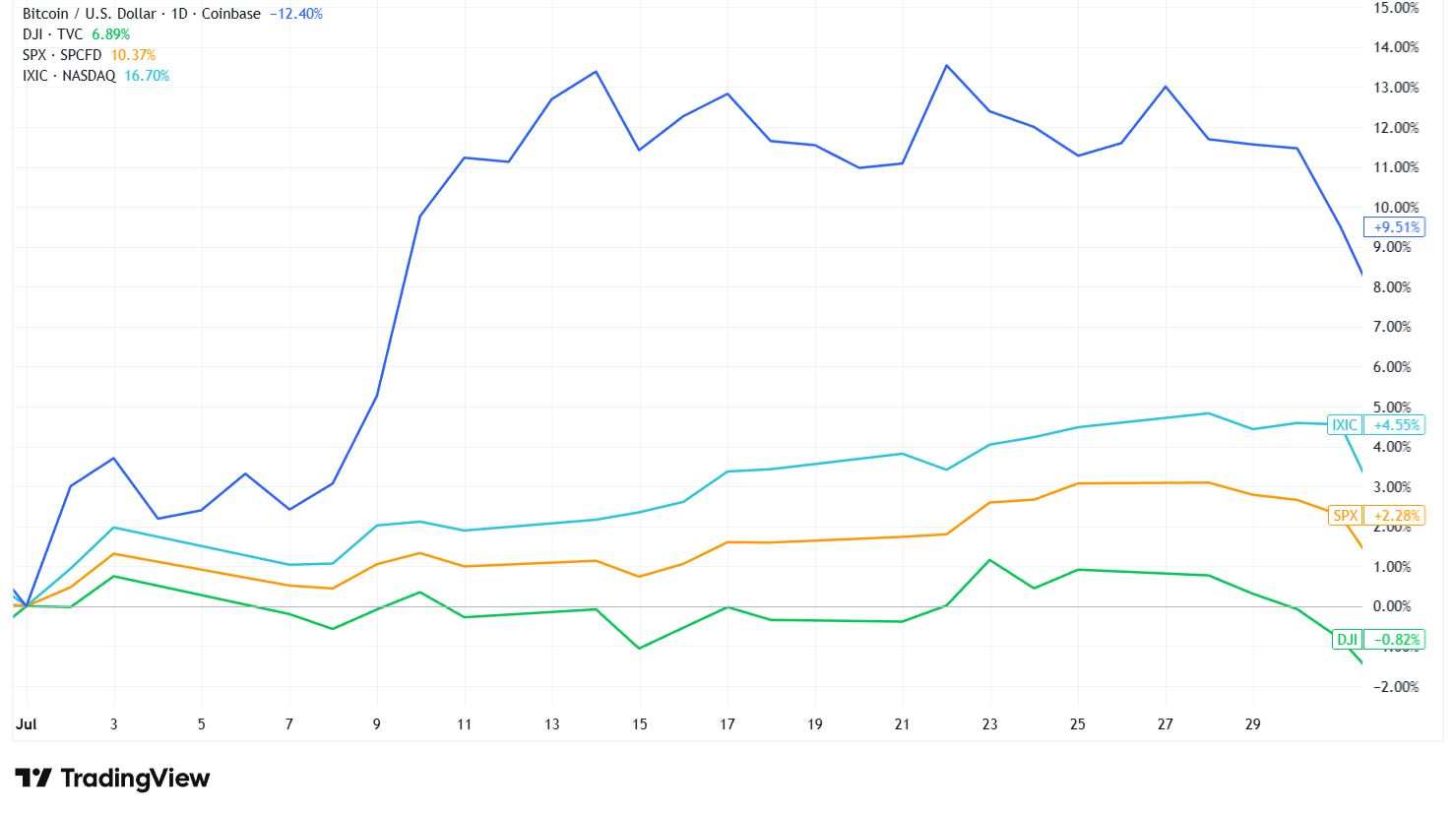

Over the last six months:

Bitcoin: about –18%.

Nasdaq: +21%.

S&P 500: +14.35%.

Dow Jones: +12.11%.

BTC still printed new all-time highs, still dodged “red September” for the third year in a row… and yet somehow managed to underperform everything when the real macro tailwinds showed up.

This issue is about that decoupling:

What actually happened month by month,

Why BTC peeled off while stocks kept climbing,

And whether that’s a regime change or just a very messy mid-cycle reset.

TL;DR

In H2 2025, BTC decoupled hard from U.S. equities:

BTC –18% over 6 months,

Nasdaq +21%, S&P +14.35%, Dow +12.11%.

The divergence started after BTC hit fresh ATHs around $124K in August and again in early October, then got wrecked by the biggest liquidation cascade in its history (~$19B wiped), amplified by a Binance glitch and heavy futures reliance.

All this happened while:

The Fed delivered three rate cuts in 2025,

Stocks rallied on easier policy, AI earnings and cooling inflation,

BTC dealt with internal upgrade drama, tariff panic, and over-levered derivatives.

November — usually BTC’s best month (avg +41%) — was its worst month of 2025, with a –17.67% drop and a break below $100K.

Standard Chartered cut its year-end 2025 BTC target from $200K to $100K, and pushed its $500K forecast from 2028 to 2030, arguing that corporate treasury demand has peaked and future upside leans more on ETFs.

Brought to you by:

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

Main Event

Same Ocean, Different Storms – How BTC Left Stocks Behind

Let’s walk the second half of 2025 the way the market lived it.

July – GENIUS Act + Nvidia $4T = everything up

Equities crab walk, while Treasurys and stablecoins lift crypto. Source: TradingView

Macro: Equities were on fire. Despite big tariff headlines (like 50% tariffs on copper), markets shrugged and focused on earnings and growth.

Nvidia became the first company to touch a $4T valuation on July 9; S&P 500 and Nasdaq printed new highs the same day.

Crypto:

BTC finished July up ~8.13%, its strongest H2 month (even including December).

Trump signed the GENIUS Act, which juiced optimism particularly for stablecoin and payment-related plays.

Corporate BTC adoption kept grinding — more companies quietly adding BTC to treasuries.

At this point, the old narrative still fit:

“Risk is back. AI + crypto both winning. BTC = high-beta tech.”

August – BTC ATH, ETH ATH… then BTC taps out

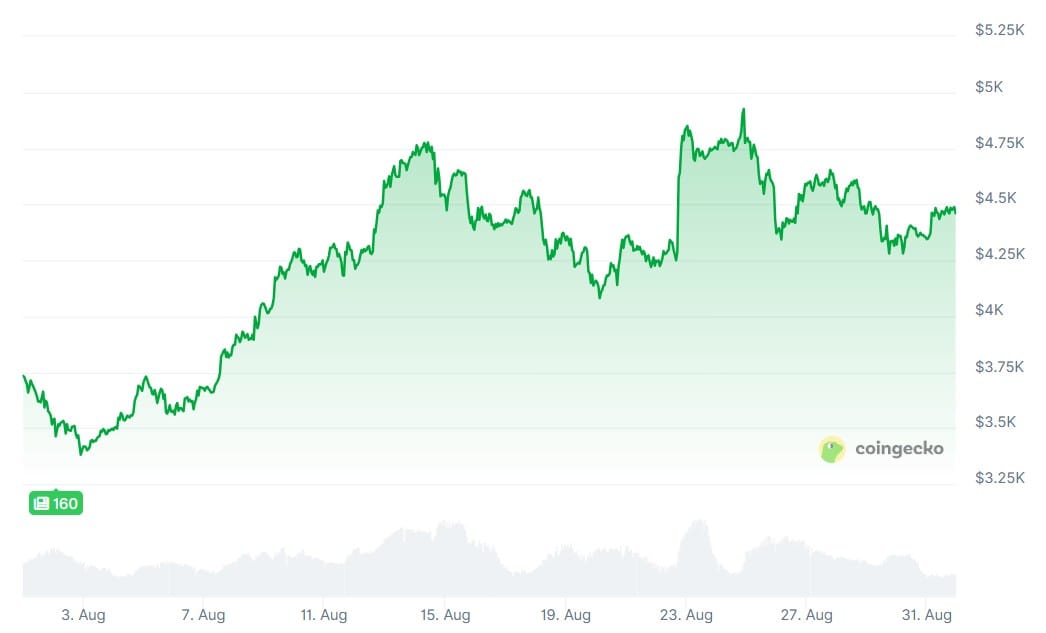

The Fed’s dovish signal sends Ether to new highs. Source: CoinGecko

Rate-cut expectations built all month as markets bet the Fed would finally blink.

Bitcoin ripped to a new ATH around $124K on Aug. 14, helped by a weaker USD and trade tensions that looked bullish for alternative assets.

On Aug. 22, at Jackson Hole, Powell gave a dovish signal: rate cuts still on the table.

Equities: loved it.

Ether: ripped to a fresh ATH.

Bitcoin: spiked briefly… then rolled over and resumed its correction. BTC ended August down ~6.49% despite the earlier ATH.

This is where the first real decoupling showed up:

Stocks: grinding higher on dovish Fed.

BTC: already in post-peak digestion mode.

September – First Fed cut, no “red September”… and internal drama

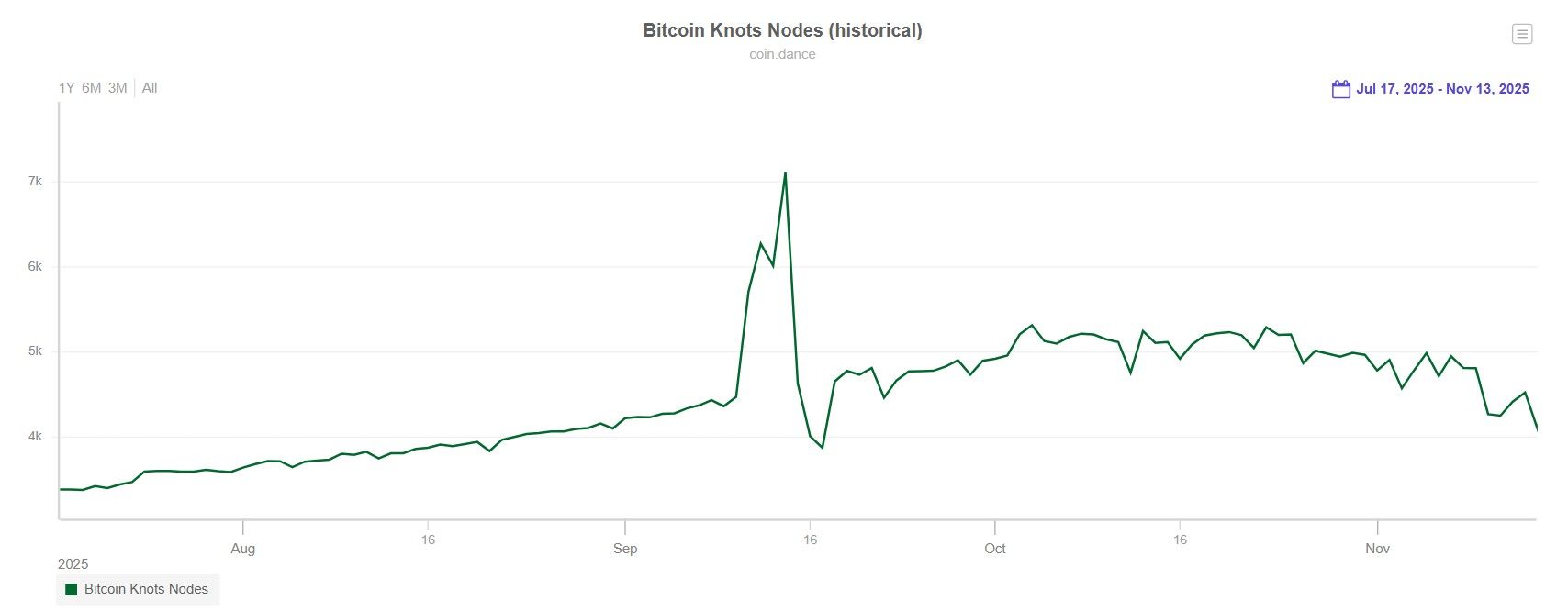

Bitcoin’s upgrade divides the community as Knots nodes rise as alternatives. Source: Coin Dance

Historically, September is one of BTC’s worst months. “Red September” is almost folklore at this point.

Not in 2025:

The Fed delivered its first rate cut of the year (–25 bps) on signs of a cooling labor market.

Stocks extended their rally on the “more cuts coming” expectation.

BTC finished September up ~5.16% — its third straight positive September, breaking the usual curse.

Under the hood, though, Bitcoin was busy fighting… itself.

A major network upgrade debate broke out over removing limits on arbitrary data in blocks.

Bitcoin Core (the dominant implementation) leaned toward lifting the cap.

Critics called non-financial data “spam” and pushed back.

Alternative client Bitcoin Knots saw rising adoption as some nodes opted out of Core’s direction.

So:

Macro: supportive.

Price: up.

Community: low-key civil war energy.

October – Uptober dies: ATH, then a $19B liquidation bloodbath

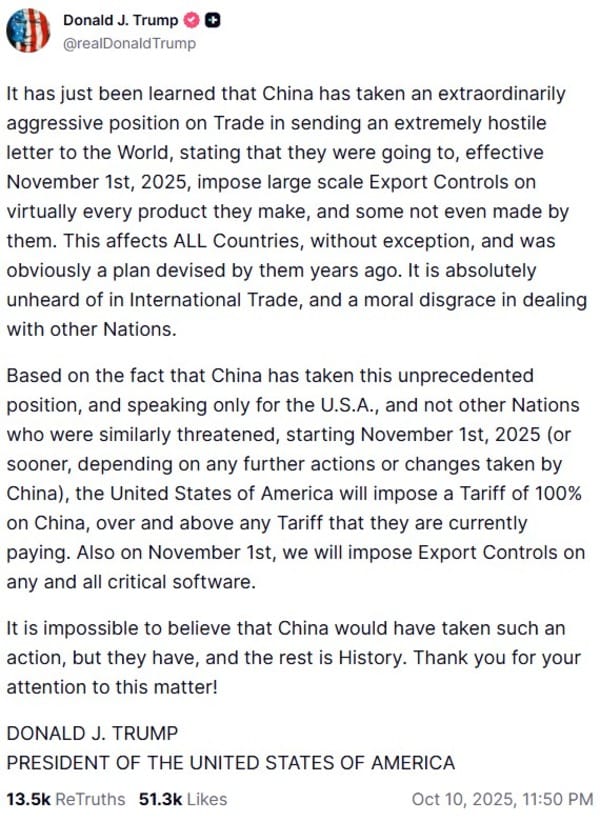

Trump’s social post sparks a crypto liquidation frenzy. Source: Donald Trump

October is usually “Uptober” in crypto lore: historically strong, high win-rate for BTC.

2025 said “nah.”

BTC tagged another all-time high on Oct. 6, then walked straight into the largest liquidation event in its history — roughly $19B in positions wiped.

Contributing factors:

A price glitch on Binance.

Heavy futures-based trading — perps and high leverage dominating flows.

Thin spot depth relative to the size of leveraged bets.

The immediate spark:

Trump posted about 100% tariffs on Chinese imports, triggering a sharp selloff in both equities and crypto.

The difference:

Equities: took the hit, then recovered as earnings + expectations of more cuts reasserted themselves.

BTC: couldn’t shake it. It snapped a five-year streak of positive Octobers and closed down ~3.69%, even though the Fed delivered its second 25 bps rate cut by month’s end.

Also in October:

The U.S. government was shut for the entire month, the longest shutdown on record — yet stocks largely looked past it. BTC… did not.

October is where the decoupling stopped being subtle and started being a chart.

November – Historically BTC’s strongest month… becomes its worst

November is historically Bitcoin’s best month, but it was the worst month of 2025. Source: CoinGlass

Fun stat:

Historically, November is BTC’s best month, with an average return of ~41.12%, more than double October’s average ~20%.

Not this time:

In November 2025, BTC fell ~17.67%, its worst month of the year.

Selling pressure pushed price below $100K by mid-month.

Meanwhile:

Equities: mostly crabbed sideways while the U.S. government shutdown finally ended.

Sentiment got whacked by AI bubble fears, especially after Oracle and others signaled heavy AI capex with slower-than-hyped profitability.

Some of those fears eased when Nvidia printed record Q3 earnings, stabilizing tech sentiment — but BTC didn’t get the relief rally equities did.

By now, BTC wasn’t trading like a “high beta stock proxy.” It was trading like:

An over-levered asset digesting a major liquidation and internal drama,

In a market where ETFs and treasuries have anchored long-term flows,

While short-term leverage and narrative whiplash ran the day-to-day.

December – Quiet so far, targets cut, optimism trimmed

As of mid-December:

BTC is up ~2% on the month; average December return historically is ~4.5%.

Major equity indices are also up modestly; the Fed has now delivered three rate cuts in 2025, with the latest cut lifting stocks but seeing BTC slip before bouncing back.

But the big tell is in how the Street talks about BTC now:

Standard Chartered cut its end-2025 target from $200K to $100K.

It also pushed its $500K forecast back from 2028 to 2030, effectively saying:

Corporate BTC treasury adoption looks near a local peak,

Future upside will lean more on ETF + institutional flows, not a second wave of Teslas putting BTC on the balance sheet.

So yes, BTC decoupled.

But it did so while graduating from “pure risk meme” into something messier: an institutional-ish asset with its own internal cycle, leverage games and governance drama.

Degen Toolbox: Trading in a Decoupled World

So how do you not get farmed when BTC stops hugging SPX?

Use a simple three-switch framework:

1. Correlation Regime Check

Once a week, ask:

Is BTC trading with major indices (Nasdaq/S&P)?

Is the 30-day or 90-day correlation stable, spiking, or flipping negative?

High positive correlation → macro & liquidity dominate.

Low or negative correlation → crypto-native factors in the driver’s seat (leverage, internal news, positioning).

You don’t need exact numbers. You just need to know which regime you’re in.

2. Three Drivers, One Trade

Before you take a swing, sanity-check:

Macro: Fed cuts/hikes, AI earnings, inflation prints → supports risk or not?

Flows: ETFs, treasuries, on-chain data → are long-horizon players still net adding?

Leverage: Funding, basis, OI → are we stretched?

If macro & flows are supportive but leverage is insane → expect volatility + fakeouts, not a smooth moon mission.

3. Stop Treating BTC as a Permanent QQQ Proxy

The H2 2025 lesson:

BTC can behave like global macro collateral or like an over-leveraged casino chip, sometimes in the same month.

You can’t just say “SPX green, so BTC go brrr” anymore.

The edge is in knowing which version of BTC you’re trading today.

We’re leaving 2025 with a very different picture than we walked in with:

Stocks: cruising on rate cuts and AI earnings.

BTC: bruised from ATHs, record liquidations and internal debates, still up big on the year but clearly on its own path.

Decoupling doesn’t mean “BTC failed.”

It means BTC finally got big and weird enough to run its own cycle inside the broader macro backdrop.

If you want to survive that world:

Watch macro.

Watch leverage.

Watch when BTC stops caring about stocks — and adjust your playbook when it does.

Correlation was training wheels.

Now we ride without them.

See you in the next one.

The Degenden Team

Reply