- DegenDen

- Posts

- Crypto Safety Is Alpha

Crypto Safety Is Alpha

7 habits to dodge crypto scams + why BTC might still have room up to 180k

Hey Degens,

Today we want to help you keep your crypto safe.

Security first, gains second.

Hacks and drainer links are still the #1 way portfolios die, not some exotic smart-contract bug.

Today we’re keeping it practical: seven habits that meaningfully lower your risk in 10 minutes.

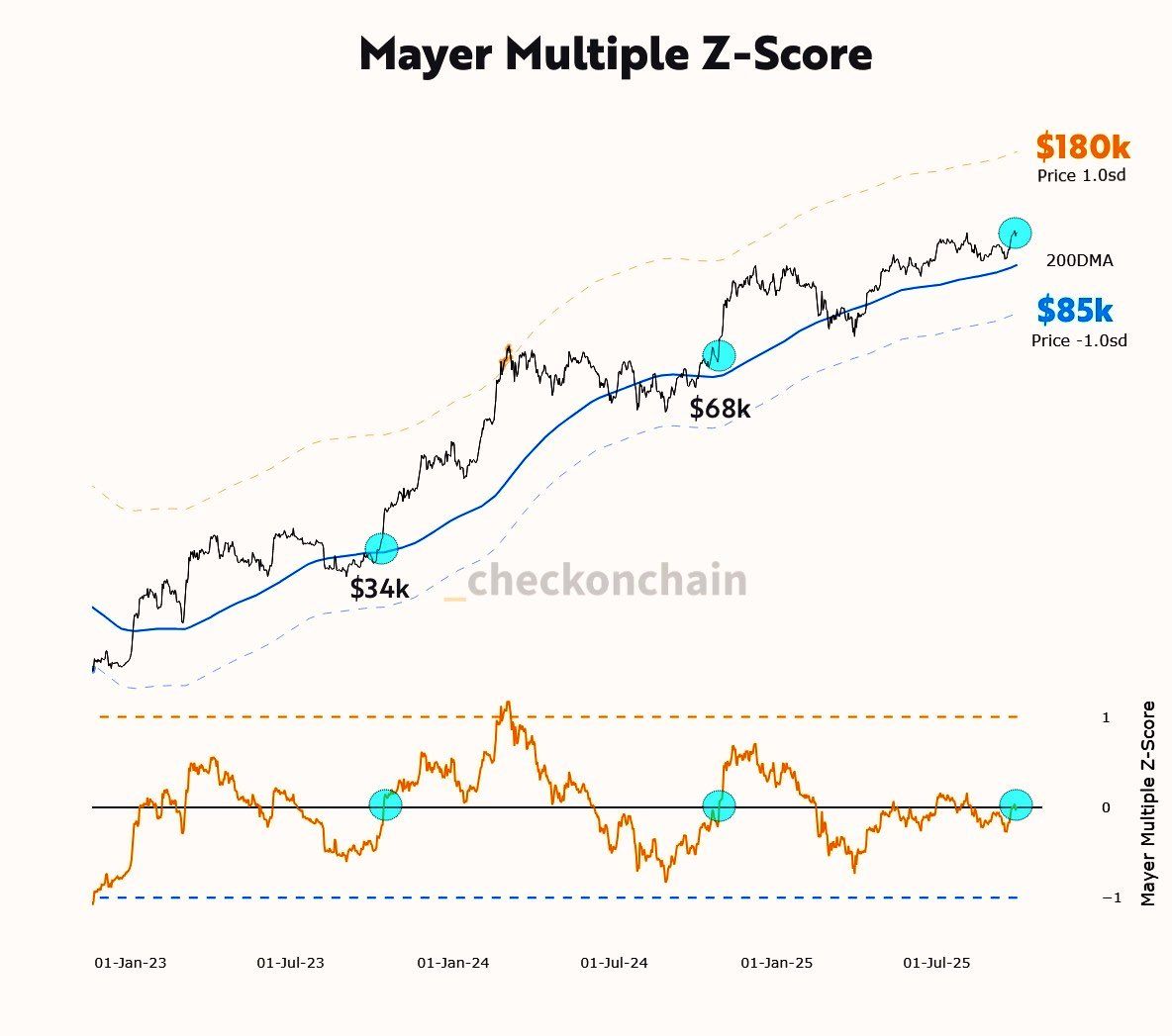

Then we zoom out: the Mayer Multiple says BTC is still far from “overbought,” with room to run toward 180k even near ATHs.

TL;DR

Most losses come from phishing, toxic approvals, SIM swaps, fake support. Fixable with better 2FA, signing hygiene, and wallet setup.

Split hot vs. cold, keep devices clean, verify contracts and chains, and prep a recovery plan.

Mayer Multiple sits ~1.16. Historically “overbought” is ~2.4, which maps to ~180k BTC. Still room.

Short term can still swing; a 10% pullback isn’t off the table. Medium term structure looks fine.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

🧃 THE RUNDOWN

Safety > everything

Seven simple habits beat 90% of everyday hacks: hardware/passkey 2FA, slow down before you sign, hot/cold split, clean devices, verify addresses/contracts, don’t get socially engineered, keep a break-glass plan.

BTC “ice cold” at highs

Mayer Multiple near 1.16 says BTC isn’t frothy. Historically “too hot” is ~2.4, which lines up around 180k if we got there.

Pullback still possible

Even with bullish on-chain, a routine 10% dip can happen and still keep the bigger trend intact.

Main Event — Crypto safety 2025: 7 easy wins

Kill SMS 2FA

Use hardware security keys or passkeys for email, exchanges, and your password manager. Turn on withdrawal allowlists. Store backup codes offline.Signing hygiene

Pause on any request withsetApprovalForAll,Permit/Permit2, or unlimited approvals. Use a burner for mints/new dapps. Revoke stale approvals regularly (Revoke.cash / explorer token approval checkers).Hot vs. cold

Treat hot wallets like checking; treat hardware or multisig like a vault. Never store seeds in cloud notes. Test your recovery with a small restore before moving size. Optional: passphrase if you can manage it.Clean devices, minimal extensions

Auto-update OS/browser/wallet. Use a dedicated browser/profile for crypto. Disable blind signing on your hardware wallet by default.Verify before sending

Confirm chain, address, and token contract from official sources (project site, CoinGecko, Etherscan). Send a tiny test first. Beware “airdrop claim” sites asking odd approvals.Beat social engineering

Romance/pig-butchering, “task” scams, and fake support are the biggest drains. Real support never asks for your seed, gift cards, or screen-share with wallets open.Have a break-glass plan

Keep an offline card with: your exchange support links, revocation tools, and reporting portals. If hit: move funds to a fresh wallet, revoke approvals, rotate passwords, enable strong 2FA, and file reports with hashes and timestamps.

Bottom line: These habits are boring, which is why they work.

Deeper Cuts - Mayer Multiple: why “room to run” still fits

Bitcoin Mayer Multiple data. Source: @FrankAFetter/X

What it measures: Price vs. 200-week MA. Historically, “overbought” risk climbs above ~2.4.

Where we are: ~1.16 — closer to “oversold” than overheated. To hit ~2.4 at current MA, BTC would be around $180k.

How to use it: It’s a regime gauge, not a day-trader signal. If you’re DCA’ing or treasury-style allocating, it says the market isn’t at classic blow-off conditions yet.

Caveat: Path ≠ straight line. A routine 5–10% pullback can happen inside a healthy trend.

Mini Hot Takes

Security alpha: In 2025, the edge isn’t a secret token list; it’s not getting drained.

Approvals are forever: Your worst click is usually an approval, not a transfer.

On-chain isn’t euphoric: Mayer says we’re not cooked; crowd still feels cautious. Good mix for slow grind up.

Stay safe, stay solvent. If you want, reply with your current setup and I’ll send a 60-second hardening checklist tailored to you.

— Dr. P & The DegenDen Team

Meme of the Day

Reply