- DegenDen

- Posts

- ETH Eyes $8.5K If BTC Runs To $150K?

ETH Eyes $8.5K If BTC Runs To $150K?

ETH to 8.5K if BTC hits 150K, record ETH ETF inflows, a whale sells into strength, and a quick check on Bitcoin’s 21M cap.

Hey Degens,

The ETH ratio trade is back on the whiteboard. One trader mapped the usual cycle pattern where ETH reaches 30–35% of BTC’s market cap.

If BTC makes it to 150K, that puts ETH somewhere between 5.3K and 8.6K.

The tape is cooperating too: ETH ETFs just had a record $1.01B inflow day. On the other side, a big ETH whale cluster sold $88M into strength and short-term holders took profits. And yes, people are debating Bitcoin’s 21M cap again.

Spoiler: it’s not changing.

TL;DR

ETH math: if BTC hits 150K and ETH retakes 30–35% of BTC mcap, ETH pencils to ~5.4K–8.6K.

Flows: spot ETH ETFs logged a record $1.01B net inflow day.

Whale action: “7 Siblings” sold $88.2M in ETH in 15 hours as short-term profit taking picked up.

Context: Ethereum TVL topped $90B and institutions are circling.

Bitcoin cap: 21M is the brand. Changing it would nuke trust and likely fork the chain.

THE RUNDOWN

Ratio Trade Back On

In big bull runs, ETH often reaches 30–35% of BTC’s market cap. If BTC tags 150K, that maps ETH to 5.3K–8.6K. Top end is your 8.5K headline.

ETF Firehose

Spot ETH ETFs just posted $1.01B in a single day of net inflows. That is real demand, not vibes.

Whale Sells Into Strength

The “7 Siblings” cluster moved 19,461 ETH for $88.2M around 4.53K average, while short-term holders realized about $553M/day in gains.

TVL Check

ETH TVL pushed past $90B. Add rising ETF interest and the setup looks constructive as long as BTC behaves.

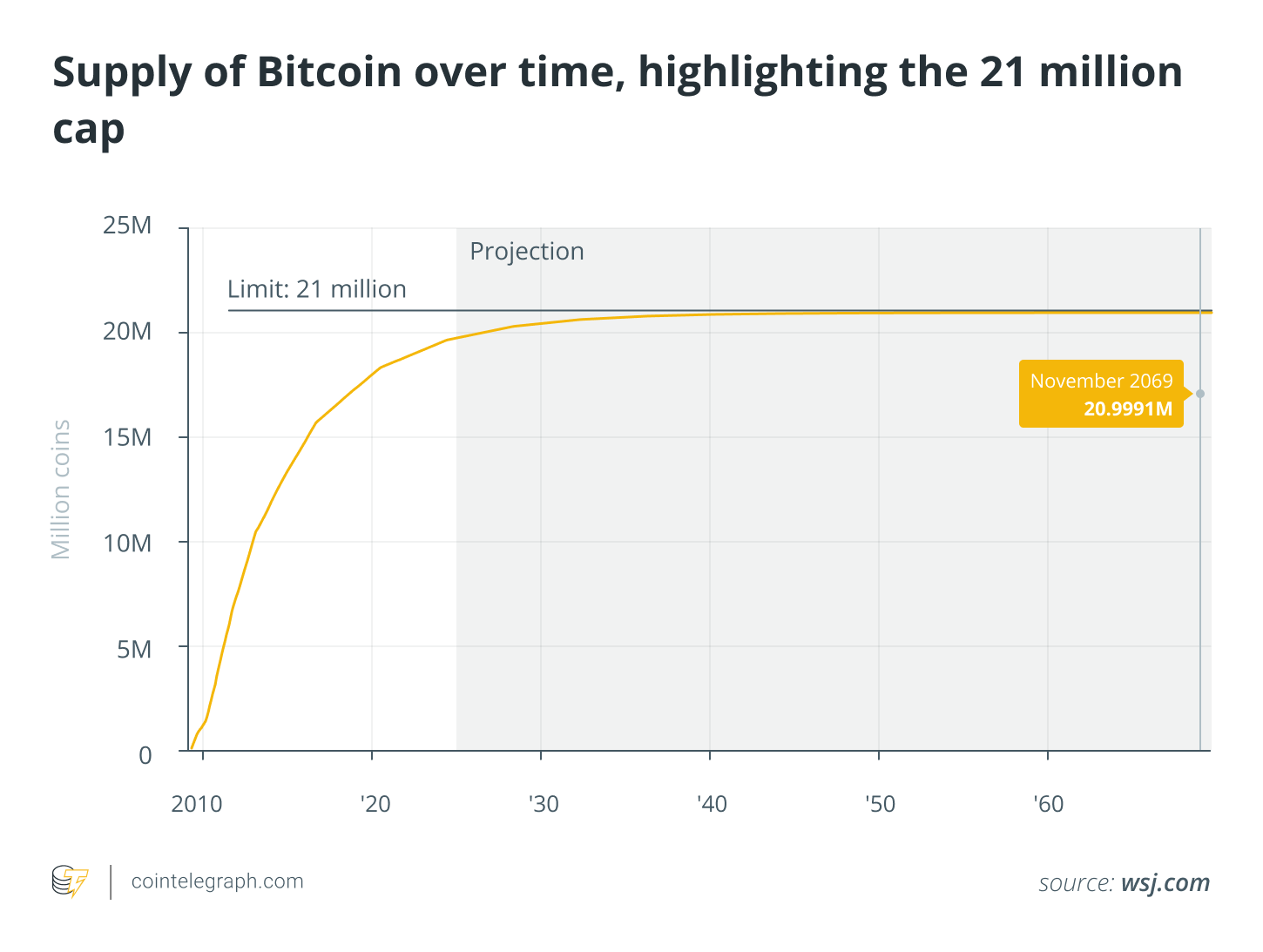

21M Means 21M

Yes, people ask if Bitcoin’s hard cap can change. Practically, no. Social consensus would reject it, trust would crater, and you’d get a fork that the market ignores.

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Main Event: Can ETH Really Print 8.5K?

The framework is simple. In past bull markets, ETH’s market cap has climbed to roughly 30–35% of BTC’s.

We saw about 36% in 2021. Apply that range to a 150K BTC and you get ~5.4K to ~8.6K ETH.

What helps this time:

Flows: the $1.01B day for spot ETH ETFs is a big tell.

On-chain base: $90B+ TVL says real activity is there.

Institutional interest: funds talking treasuries and structured ETH exposure.

What can cap it:

Profit taking: whales and short-term holders are selling rips.

Path dependency: the 8.5K scenario assumes BTC actually gets to 150K.

Market plumbing: sharp rotations can whipsaw alts if BTC stalls.

My read: the ratio math is fair. If BTC trends cleanly higher, ETH has room to outperform on the way to and through ATH. Expect stair-steps, not a straight line.

Deeper Cuts

Bitcoin’s 21M Hard Cap, Revisited

It’s code, so technically you can propose anything. Practically, the social layer is the lock.

Source: Cointelegraph

Changing supply would destroy credibility, trigger a fork, and likely die on node and miner consensus. Fees plus halvings were the original plan for long-term security. That still stands.

The Whale Tell

The “7 Siblings” activity spanned multiple wallets and routed through Aave v3. Translation: sophisticated treasury management, not panic. Sells into strength are normal when ETFs are absorbing. It’s healthy if dips keep getting bought.

Institutional Tilt

Beyond ETFs, there are loud plans to raise big checks for ETH purchases. Treat headlines as intent, not immediate flow. What matters is the tape: that $1.01B day is the proof.

Net inflows into spot Ether ETFs exceeded $1 billion on Monday. Source: Farside Investors

Mini Hot Takes

ETF prints beat narratives. A billion in a day speaks louder than Twitter threads.

If BTC legs up cleanly, ETH usually runs faster on the ratio.

Whale sells are a feature, not a bug, when the buyer is an ETF.

The 21M cap debate is interesting. It’s not happening.

The setup is straightforward. If BTC grinds toward 150K, ETH has a clean map to 5K–8K with real flow behind it. Profit taking will keep showing up. That’s fine. It’s what strong trends look like.

See you next time

— The DegenDen Team

What did you think of today's email?Your feedback helps us create better content for you! |

Reply