- DegenDen

- Posts

- Fed cut, BTC dipped. Why?

Fed cut, BTC dipped. Why?

What the market’s actually pricing — and why $150K still isn’t off the table.

Hey Degens,

Markets did the classic “good news, bad candle.” The Fed cut 25 bps and even called time on QT starting Dec 1… and BTC still dropped to ~$109K.

Why? Because the cut was priced in, and everyone’s gaming what comes after: jobs softness, sticky-ish inflation, tariffs, and whether this post-FOMC dip sets up the usual bid-soaked rebound.

Today’s issue: what the tape’s saying now, what could flip it, and why Saylor still has $150K on his 2025 bingo card.

Strap in.

TL;DR

The Fed cut 0.25% and will end QT on Dec 1… and Bitcoin still dumped to ~$109.2K.

Near-term tape cares more about jobs, inflation, tariffs, and “what’s after the cut” than the cut itself.

Playbook we’ve seen before: post-FOMC dip → potential upside if order books flip bid-heavy.

Saylor’s base case: $150K BTC by end of 2025, leaning on the U.S. policy pivot (tokenized securities + stablecoins) and steady ETF/treasury demand.

Crypto’s Most Influential Event

This May 5-7 in 2026, Consensus will bring the largest crypto conference in the Americas to Miami’s electric epicenter of finance, technology, and culture.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus Miami will gather 20,000 industry leaders, investors, and executives from across finance, Web3, and AI for three days of market-moving intel, meaningful connections, and accelerated business growth.

Ready to invest in what’s next? Consensus is your best bet to unlock the future, get deals done, and party with purpose. You can’t afford to miss it.

Main Event — The “good news, bad candle” day

The Fed delivered the expected 25 bps cut and confirmed QT ends Dec 1.

That’s liquidity-friendly over quarters, not hours.

The market already priced the cut, so traders immediately looked past it to the macro backdrop: softening jobs, inflation still a conversation, and the tariff overhang.

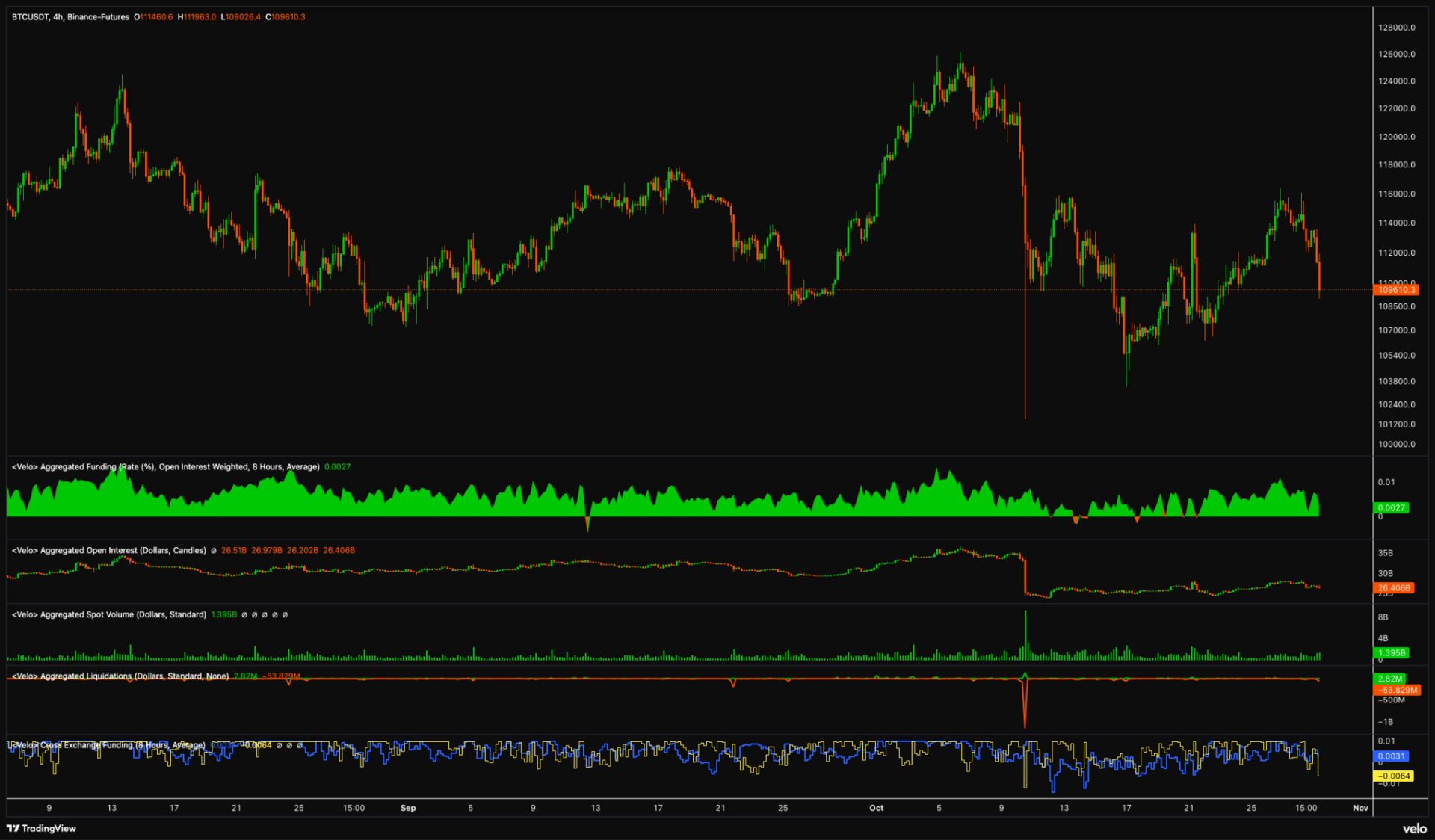

Result: BTC slid to ~$109.2K from Monday’s pop to ~$116.4K. It feels counterintuitive, but it’s classic “buy the rumor, sell the meeting.”

BTC/USDT 4-hour chart (Binance perps). Source: Velo

Hyblock’s note sums it up: FOMC days often bring a down move first, then up once bullish confluence shows up (e.g., bid-heavy books).

Dot plot vibe: Three cuts penciled in for 2025. Goldman even sees more in 2026 (landing policy around 3.0–3.25%). That’s a tailwind over time, not an insta-moon.

Levels & set-ups (keep it simple)

Spot: ~$109K is the line we just tested. If it’s lost on closes, the path of least resistance is lower before buyers try again.

What flips momentum: Evidence of bid support building after the FOMC fade. If that shows up, the “dip then rip” play can still play out.

How I’d approach it (not advice):

No hero longs mid-flush. Let price reclaim levels on decent volume, then retest and hold. If books turn bid-heavy and the retest sticks, size accordingly. If not, dodge the knife.

Big Call — Saylor’s $150K by year-end 2025

Saylor calls the last 12 months the best in the industry’s history and plants a flag at $150K by end-2025. His logic:

Regulatory pivot in the U.S.: SEC giving tokenized securities a path; Treasury backing stablecoins to defend dollar dominance.

Structural demand: ETFs and corporate treasuries soaking more supply than miners create.

Macro was noisy (tariffs sparked a crash), but diplomacy is thawing: U.S.–China rhetoric relaxed, a “substantial” framework reportedly in place, and a Trump–Xi meeting teed up at APEC.

If trade headlines stay constructive and the Fed keeps easing, risk assets can catch a bid fast. As Pomp put it: if both hit, “buckle up.”

Quick FAQ energy

Why down on a cut?

Because the cut was 100% expected. The tape trades what’s new: jobs, inflation stickiness, tariffs, and “what’s next after this cut.” Ending QT is bullish over time, but it doesn’t arm-wrestle a crowded book in the next 4 hours.

So… bullish or bearish?

Tactically: neutral-to-cautious until we see a reclaim + retest. Structurally (multi-quarter): easing path + policy clarity + treasury/ETF demand is bullish. Two different clocks.

The cut wasn’t the catalyst; it was the starting gun for the next macro leg.

If the market likes what comes next (jobs, inflation trend, trade detente), Saylor’s $150K call by end-’25 stays very live.

For today? Respect the tape, trade the confirmations.

See you on Friday

— The DegenDen Team

Meme of the Day

Reply