- DegenDen

- Posts

- How to Dodge Crypto’s Fakeouts (Before They Dodge You)

How to Dodge Crypto’s Fakeouts (Before They Dodge You)

A simple, trader-tested playbook to sniff out bull traps, bear traps, and stop giving your stack to forced liquidations.

Hey Degens,

Crypto runs 24/7, leverage is everywhere, and books get thin when you least expect it.

That combo breeds fake breakouts or fakeouts.

Today’s edition is a straight-to-the-point guide on spotting bull and bear traps before they catch you.

Nothing crazy, just rules, and a checklist you can actually use.

TL;DR

Wait for proof: higher-timeframe close + clean retest, then size up.

Read the room: extreme funding + rising OI into a key level = trap risk the other way.

Don’t chase off-hours breaks: thin books, spoof orders, listings/unlocks can fake moves.

Respect liquidations: cascades = forced flow; snapbacks often follow once the leverage clears.

Run a pre-trade checklist; if the setup fails it, skip it. There’s always another trade.

Crypto’s Most Influential Event

This May 5-7 in 2026, Consensus will bring the largest crypto conference in the Americas to Miami’s electric epicenter of finance, technology, and culture.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus Miami will gather 20,000 industry leaders, investors, and executives from across finance, Web3, and AI for three days of market-moving intel, meaningful connections, and accelerated business growth.

Ready to invest in what’s next? Consensus is your best bet to unlock the future, get deals done, and party with purpose. You can’t afford to miss it.

🧃 THE RUNDOWN

Confirmation over hope

Breaks without a four-hour/daily close and a retest that holds are just pokes. Wait for both.

Leverage fingerprints

Spiking positive funding and climbing OI at resistance? That breakout can be bait. Deeply negative funding + OI flush at support? Watch for bear-trap squeezes.

Thin-book theater

Weekends, off-hours, listings, unlocks — great times for manufactured wicks. Let the retest decide.

Liquidation context

Cascades often mark exhaustion. After the flush, snaps back through the level are common.

Main Event — Spotting the Traps

Bull traps (fake ups)

What it looks like:

Price peeks above resistance on meh volume, no follow-through, then closes back inside the range.

Source: xs.com

Funding flips hot and OI balloons into the level — late longs pile in and get rinsed.

Confirm it’s real:

Four-hour/daily close above.

Retest the level and hold.

Volume expands on the break; funding cools on the retest; OI rebuilds (not unwinds).

If any piece is missing, assume elevated bull-trap risk and keep size small.

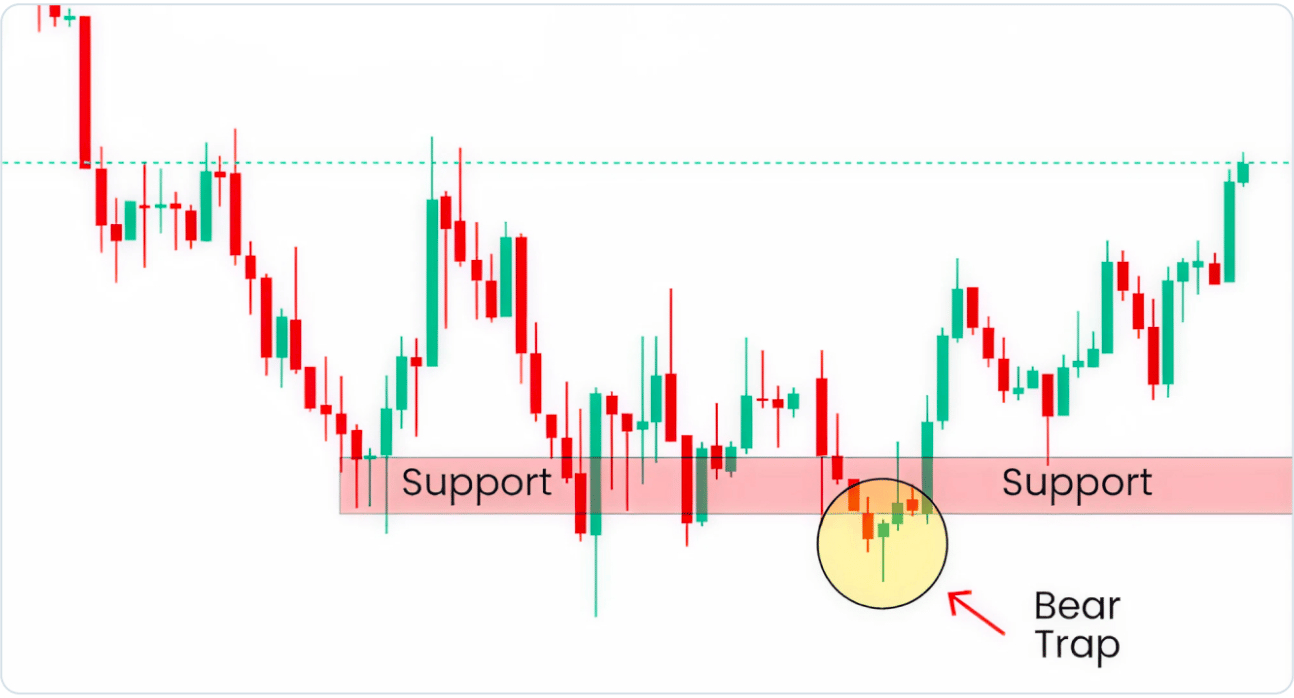

Bear traps (fake downs)

What it looks like:

Quick stab below support (often just a wick), then an aggressive reclaim. Funding turns deeply negative into the dip and OI flushes — crowded shorts.

Source: xs.com

Confirm it’s real:

Close back above the level on a higher timeframe.

Next pullback makes a higher low above the reclaim.

Volume and OI stabilize/build instead of vanishing.

If the reclaim fails on retest, step aside.

Deeper Cuts — The Tells That Matter

Funding (perps)

Strongly positive = crowded longs; mean-reversion risk down.

Deeply negative = crowded shorts; squeeze risk up.

Open Interest (OI)

Rising into a key level = more fuel for a squeeze.

Sharp OI flush during the move = forced de-risking; watch for snapback if price reclaims.

Liquidations

Clusters get tagged, forced orders fire, then markets often snap once the forced flow clears.

Order book & timing

Off-hours = wider spreads, less depth, easier to push. Spoofs can fake support/resistance.

Listings and unlocks can temporarily overwhelm depth, creating head-fakes that fade on retest.

Mini Hot Takes

“Breakout” without volume is just marketing.

If funding is screaming and OI’s swelling, price is wearing gasoline. Don’t hold the match.

Weekends are where good trades go to get chopped.

Your first defense isn’t an indicator, it’s waiting for the retest.

Ugly day, clean levels. If banks settle down and BTC reclaims 110–112K, expect a relief rip. If not, $101–100K is where the market will try to write a higher-low story.

This market rewards patience more than hero entries. Use confirmation, respect leverage, and let bad breaks fail without you.

See you on Friday

— The DegenDen Team

Meme of the Day

Reply