- DegenDen

- Posts

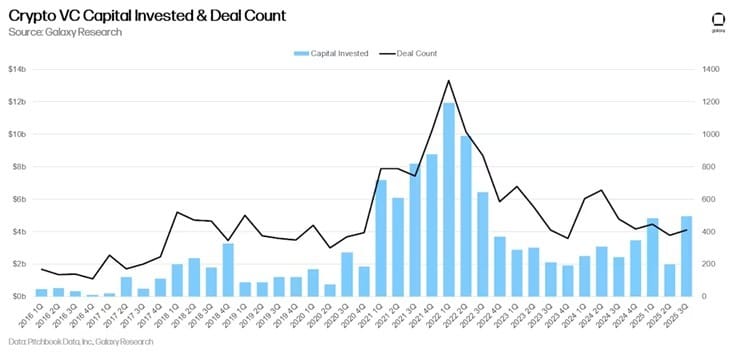

- VC Winter, Santa Rally? Capital Is Getting Picky, Not Gone

VC Winter, Santa Rally? Capital Is Getting Picky, Not Gone

Deal counts are near cycle lows, but nine-figure checks, tokenized funds and banks rolling out in-app crypto say the game isn’t over — it’s just harder to join.

Intro

Hey Degens,

If you’re an early-stage founder, this cycle probably feels like a cosmic joke:

Headlines: “Revolut raises $1B.” “Kraken pulls in $800M ahead of IPO.”

Your inbox: “Hey, great deck. Unfortunately we’re focused on later-stage opportunities at this time.”

November’s VC data basically confirms the vibe:

Deal counts near yearly lows.

Funding totals propped up by a few mega-raises.

Most of the actual checks went to CeFi, DeFi, RWA and AI-adjacent infra, not random “new L1 for dogs.”

And yet… on the adoption side:

WisdomTree just took a sophisticated options income strategy and put it onchain.

French banking giant BPCE is about to let millions of normies buy BTC/ETH/SOL/USDC in their banking app.

Coinbase Institutional is openly calling for a December recovery, pointing at global liquidity and Fed cut odds.

So no, the game isn’t over.

It just got a lot more selective.

Let’s break down what’s actually happening.

Your Thoughts on DegenDen |

TL;DR

Crypto VC funding is muted: November saw only 57 disclosed deals, one of the weakest tallies this year, even as big rounds like Revolut’s $1B and Kraken’s $800M dominated the headlines.

Capital is clustering around CeFi, DeFi, NFT-GameFi, RWA and AI–Web3 infra, with examples like Ostium ($24M onchain perps for RWA), Axis ($5M onchain yield across BTC/gold/USD), and PoobahAI ($2M for no-code tokenized networks + AI agents).

VCs are doing fewer deals in tougher conditions — which historically is where some of the best vintage returns come from, as Sarah Austin notes.

Meanwhile, TradFi keeps creeping onchain: WisdomTree launched an onchain Equity Premium Income Digital Fund tracking a put-write index, now running a suite of 15 tokenized funds including a digital government money market fund with >$730M in assets.

BPCE, France’s 2nd-largest banking group, is rolling out in-app trading for BTC, ETH, SOL and USDC to ~2M customers to start, with a plan to reach ~12M retail users by 2026.

Coinbase Institutional is calling for a December recovery in BTC and crypto, citing rising global M2, a ~92% probability of a Fed rate cut as of Dec 4, and improving liquidity as macro tailwinds.

Brought to you by:

Invest in Renewable Energy Projects Across America

Across America, communities are being powered thanks to investors on Climatize who have committed to a brighter future.

Climatize lists vetted renewable energy investment offerings in different states.

As of November 2025, over $13.2 million has been invested across 28 projects on the platform, and over $3.6 million has already been returned to our growing community of thousands of members. Returns aren’t guaranteed, and past performance does not predict future results.

On Climatize, you can explore vetted clean energy offerings, including past projects like solar farms in Tennessee, grid-scale battery storage units in New York, and EV chargers in California. Each offering is reviewed for transparency and provides a clear view of how clean energy takes shape.

Investors can access clean energy projects from $10 through Climatize. Through Climatize, you can see and hear about the end impact of your money in our POWERED by Climatize stories.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

Main Event

VC Winter, Adoption Summer

Let’s start with the uncomfortable bit: VCs aren’t writing as many checks.

1️⃣ Fewer deals, bigger cheques, higher bar

Crypto venture capital funding and deal activity remain well below levels seen in previous bull markets. Source: Galaxy Digital

Data from RootData and others:

Only 57 disclosed crypto rounds in November 2025, down sharply from prior months and way below bull-market frenzies.

Total dollar funding looks okay on paper only because of a few mega-events (e.g., Revolut’s $1B, Kraken’s $800M + earlier big acquisitions).

Most of the action is now around established companies and later-stage plays, not seed-stage experiments.

Galaxy and others have highlighted that:

The long-term correlation between BTC price and VC flows has broken down — price recovered faster than VC confidence.

Sarah Austin (Titled) puts it bluntly: backing fewer early-stage projects in tough markets hurts the whole ecosystem, because historically the best deals are made in bad conditions, not near the top.

This is the VC winter:

Not “no money,” just selective money.

2️⃣ Where the money is going

Look at the three highlighted deals in November’s VC roundup:

Ostium – $24M

Onchain perpetuals protocol, but focused on real-world markets: stocks, commodities, indices, FX.

Backers include General Catalyst, Jump, SIG and angels from Bridgewater, Two Sigma, Brevan Howard.

Translation: RWA + perps + serious quants.

Axis – $5M

Onchain yield infrastructure giving exposure to BTC, gold and USD.

Led by Galaxy Ventures, with OKX Ventures, Maven 11, CMS and FalconX in the mix.

Already stress-testing with $100M of private capital through their beta. This is very “we’re building rails for real size,” not a degen farm.

PoobahAI – $2M seed

No-code platform to spin up tokenized Web3 networks + AI agents.

Led by FourTwoAlpha (early ETH / Cosmos investor).

Perfect Venn diagram: AI x Web3 x infra.

The pattern:

Capital is clustering in infrastructure that touches real-world rails, AI, and yield — not random “number go up” tokens.

3️⃣ At the same time, the rails are getting very real

While early-stage founders fight for scraps, TradFi is quietly doing this:

WisdomTree: tokenized options income

They launched the WisdomTree Equity Premium Income Digital Fund (EPXC) — a tokenized fund tied to a US large cap put-write options index.

This isn’t just “we put a stock on a chain.” It’s a complex options overlay strategy, onchain, with a digital share class alongside traditional vehicles.

WisdomTree now runs ~15 tokenized funds on platforms like WisdomTree Prime and Connect, including a tokenized government money market fund with $730M+ in AUM.

This is what “tokenization” was supposed to mean before everyone got distracted by JPEGs.

BPCE: 12 million French retail users getting a big orange “Buy BTC” button

BPCE (Banque Populaire + Caisse d’Épargne group), one of France’s biggest banking giants, is rolling out in-app crypto trading.

Phase 1: ~2 million customers across a few regional banks will be able to buy/sell BTC, ETH, SOL, USDC inside the existing app via a dedicated digital asset account.

Plan: gradually expand to all ~12 million retail clients by 2026 if performance/UX check out.

Remember when you needed a shady offshore exchange, a burner email and a PDF of your passport to buy $200 of BTC?

Now French normies are going to do it between checking their mortgage and paying the electricity bill.

4️⃣ Coinbase: “Santa rally is on the table”

On the market side, Coinbase Institutional is basically telling clients:

“Yes, November sucked. But December might not.”

Their core thesis:

Global M2 liquidity is ticking up again.

As of Dec 4, traders are assigning ~92% odds to a Fed rate cut — plus expectations of the end of quantitative tightening.

Those macro tailwinds historically support risk assets (equities + crypto).

They called for October weakness earlier this year based on money supply, and are now expecting a December reversal / recovery.

Layer that on top of everything above and the picture looks like:

Cheap money is creeping back in.

Adoption rails (banks, tokenized funds) are coming online.

VC is not dead, it’s just done funding every random L2 and dog coin.

Degen Toolbox: How to Use VC Data Without Copium

Most CT “VC talk” is just vibes, but you can actually use this stuff:

1️⃣ Track deal count, not just total dollars

A month with $10B in funding across 10 deals is worse for you than

$2B across 300 deals, if you’re early-stage or investing in innovation.Right now we’re clearly in a “few big checks, many passed decks” regime.

For builders:

Assume your category needs to be obvious (RWA rails, real yield, infra, AI-adjacent) to get VC attention. Everything else? Build lean, revenue-first.

For investors:

Low deal counts + selective capital often produce the best vintages later — if you’re willing to back weird stuff before it’s obvious.

2️⃣ Follow where the rails are going

When you see:

Tokenized government money markets with hundreds of millions in AUM.

Major banks doing in-app crypto for millions of normies.

You’re not early on “crypto exists.”

You are early on:

Which protocols these rails plug into,

Which assets become “default” holdings,

Which infra becomes boring but indispensable.

That’s where long-term upside lives.

3️⃣ Hedge narratives with macro

Coinbase’s call is a good reminder:

Liquidity and policy (M2, Fed cuts, QT) still matter, even in a “mature” crypto cycle.

Even if you’re a chain-maxi, your PnL is downstream of dollar flows and rates more than you want to admit.

So:

Have a “macro-lite” dashboard: M2, Fed probabilities, key inflation prints.

Use it not to trade CPI candles, but to frame why flows are dry or hot

Here’s the paradox:

VC deal flow is cold.

Big checks, big banks, and big asset managers are more in than ever.

If you’re building, it means:

You can’t sell a vibe; you have to sell rails, yield, infra or real usage.

You’re competing with Revolut, Kraken, RWA perps and AI-onchain infra for capital.

If you’re trading/investing, it means:

Don’t confuse VC winter with “crypto is dead.”

The rails getting built today — tokenized funds, bank integrations, on-chain yield are exactly the things that make the next cycle bigger and more vicious.

The game didn’t stop.

It just stopped being easy.

See you in the next one.

The Degenden Team

Reply