- DegenDen

- Posts

- 🎂 Bitcoin turns 17... and “Uptober” just flat-lined

🎂 Bitcoin turns 17... and “Uptober” just flat-lined

From white-paper day to a $2T asset — but 2025 may be the first red October since 2018. What does that set up for November?

Hey Degens,

Seventeen years ago today, someone named Satoshi dropped a 9-page PDF and nuked finance from orbit.

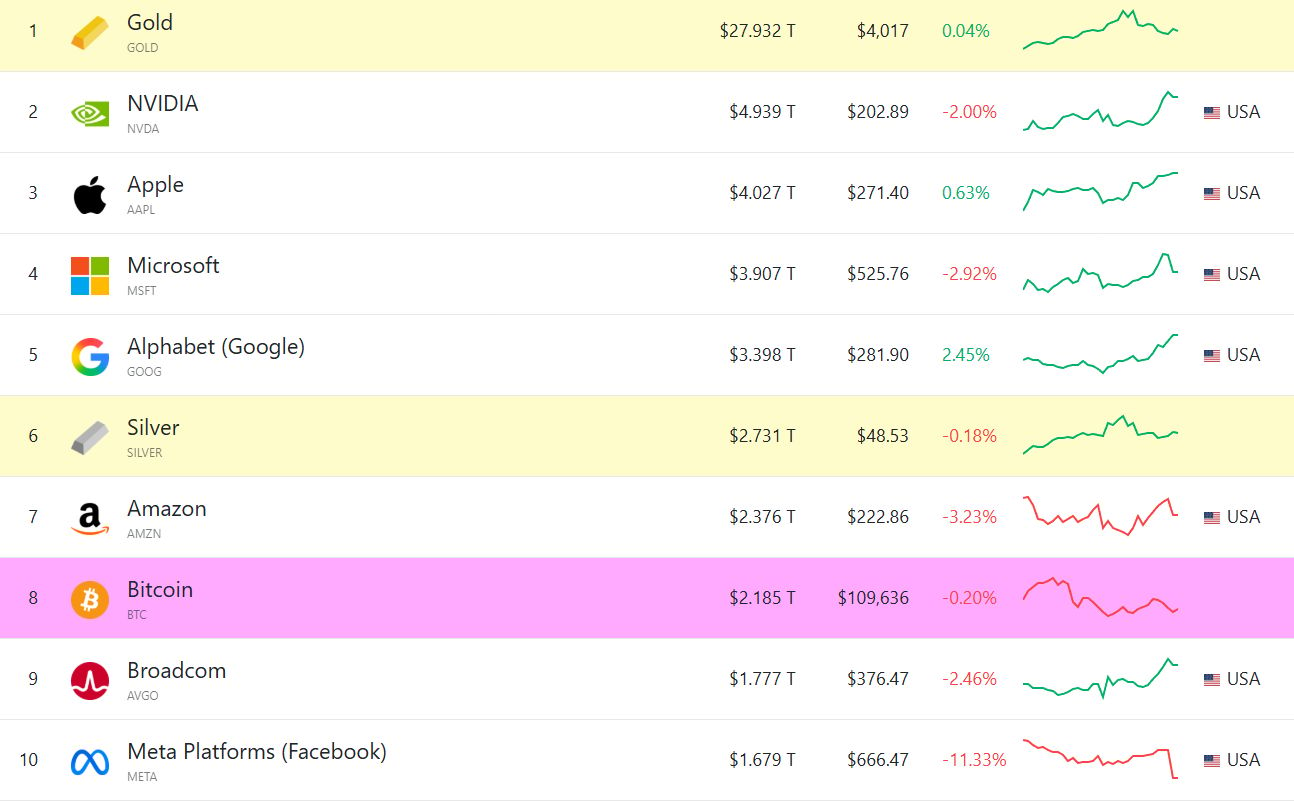

Fast-forward: Bitcoin sits in the global top-10 assets, enjoying $2T, and yet… this October? Red. First time since 2018.

Happy birthday, volatility.

TL;DR

BTC turns 17 today (white paper day). From cypherpunk PDF to ~$2T asset.

“Uptober” broke: first red October since 2018 (≈ –3.5%). Mid-month flush to ~$104K looked like controlled deleveraging.

History check: November is usually BTC’s best month (~+46% avg); Q4 has been a powerhouse (~+78% avg since 2013).

Caveat: 2018’s last red October was followed by a –36.6% November. Also, there’s no strong October→November correlation—expectation management matters.

Macro backdrop: A 25 bps Fed cut + easing US-China tone didn’t goose prices—positioning/derivatives drove the tape.

My read: Birthday dip isn’t destiny. If spot demand steps back in, November can grind up; if not, one more dunk before the next leg.

Crypto’s Most Influential Event

This May 5-7 in 2026, Consensus will bring the largest crypto conference in the Americas to Miami’s electric epicenter of finance, technology, and culture.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus Miami will gather 20,000 industry leaders, investors, and executives from across finance, Web3, and AI for three days of market-moving intel, meaningful connections, and accelerated business growth.

Ready to invest in what’s next? Consensus is your best bet to unlock the future, get deals done, and party with purpose. You can’t afford to miss it.

Main event — The 17-year glow-up meets a rare red October

Oct 31, 2008: “Bitcoin: A Peer-to-Peer Electronic Cash System” hits the cypherpunk list. Three months later, the genesis block lands.

Bitcoin white paper.

Today: Bitcoin has grown into a multi-trillion-dollar heavyweight, now eighth-largest asset on earth by value.

Top global assets by value. Source: CompaniesMarketCap

But: The streak snapped. Historically, October (“Uptober”) averages ~19.9% gains and hadn’t closed red since 2018. This month? -3.5%+ with a mid-month flash crash to ~$104K. Analysts framed it as controlled deleveraging—flush the excess, reset the board.Levels & set-ups (keep it simple)

Bitcoin monthly returns. Source: CoinGlass

Spot: ~$109K is the line we just tested. If it’s lost on closes, the path of least resistance is lower before buyers try again.

What flips momentum: Evidence of bid support building after the FOMC fade. If that shows up, the “dip then rip” play can still play out.

How I’d approach it (not advice):

Let price reclaim levels on decent volume, then retest and hold. If books turn bid-heavy and the retest sticks, size accordingly. If not, dodge the knife.

Check out our last edition to understand where are we going: Fed cut, BTC dipped. Why?

Deeper cuts — So… what does a red October usually mean?

Traders are split. A few camps to understand:

“Setup, not signal.” Some see a red October as nothing more than a springboard. The last quarter is historically Bitcoin’s best: Nov averages ~46%, and Q4 has averaged ~78% since 2013. Recent Q4s: +57% (2023), +48% (2024). 2017? A face-melting +480% from Oct 1 to Dec 1.

The 2018 ghost. The last red October (2018) was followed by a -36.6% November. It’s the bear-case chart everyone is reposting.

“October doesn’t predict November.” Research notes basically no tight correlation between a red/green October and the next month’s return. That said, after weak Octobers, the next 3 months average ~11%, versus ~21% after strong ones. Translation: you might still get green, just a tamer green.

Macro spice this month:

Fed cut 25 bps mid-week; didn’t rescue BTC.

US-China tariff angst helped trigger the mid-Oct air-pocket.

Net: rate-cut hopes + easing trade tension didn’t outweigh positioning/derivatives washouts—at least not yet.

What I’m watching (and how I’d play it)

Purely for context, not advice.

Directionless October ≠ doomed Q4. With November historically a beast, I’m treating this as a reset, not a eulogy.

Two valid paths:

Base-and-go: Leverage is cleaner after the mid-month flush; if spot demand steps back in, November can grind higher.

One more dunk: 2018 echo stays on the table—if macro jitters flare or momentum can’t reclaim key levels, we chop or slip before the next leg.

Bottom line: The birthday candle’s lit. Whether we get confetti or one more gut-check depends less on the “Uptober” meme and more on how November’s flows show up after this reset.

Seventeen years in: BTC has eaten doubt for breakfast and still shows up to work. Red October stings, sure—but it’s also how this asset shakes weak hands before it moves. On to November.

— The DegenDen Team

Meme of the Day

Reply